Rolex’s Big Move and Controlling the Brand Experience

Rolex is in the news today; the brand is buying Bucherer, one of the most important watch retailers in the world.

This is a dramatic move which will have implications for Rolex and the broader watch industry. It also reflects an important trend in the world of branding.

Rolex

Across the globe, Rolex is one of the most recognizable luxury brands. With a distinctive look and a curious positioning based on a mix of adventure, sport and luxury, Rolex is held in high regard. The brand is a symbol of achievement and success.

The company is privately held, so information on Rolex can be hard to find, but there is every reason to think Rolex is doing exceptionally well; demand is so strong that it can be hard to even find a Rolex to buy. The firm’s second brand, Tudor, is also doing well.

Rolex is particularly interesting because it has a luxury positioning while not actually being one of the more exclusive brands in the industry. The company makes about 1 million watches a year with a selling price of about $7,000 to $12,000. This isn’t close to the high-end watch brands. Patek Philippe, for example, sells its entry model for over $20,000 and only makes about 60,000 a year.

Still, Rolex remains a distinctive, valuable brand that people love.

The Bucherer Purchase

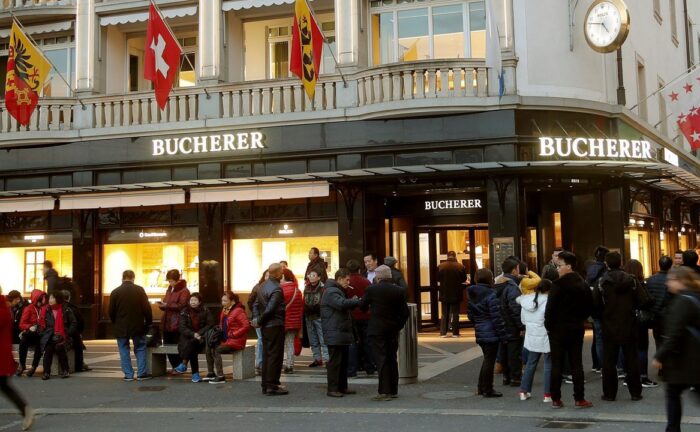

Buying Bucherer is a big move for Rolex. Carl-Friedrich Bucherer founded the company back in 1888 in Lucerne. Bucherer makes watches under the Carl F. Bucherer brand. It is better known as a retailer; the firm has more than 100 locations including 36 stores in Europe and 32 in the United States. Bucherer has sold Rolex watches for decades. The company also sells other brands like Tissot, Longines, Panerai and Breitling. Bucherer purchased watch retailer Tourneau in 2018.

With the purchase, Rolex goes from being a watch manufacturer to a watch manufacturer and retailer.

The Logic

The strategy behind this move seems quite clear: Rolex wants to control the brand experience.

While Rolex stores seem to be present in all the luxury shopping areas of the world, these are not actual Rolex stores. These are authorized retailers. Rolex has only one company owned store.

Working with authorized retailers is appealing because a company doesn’t have to own and manage the stores. Building a retail network is costly and risky. The management challenge is huge, especially as security concerns increase. When crime is surging, who wants to be standing behind a display case full of Rolex watches?

The problem is that authorized retailers are a challenge, too. First, it can be difficult to ensure that a retail partner is creating the brand experience you want. Is the staff properly trained and motivated? Are customers cared for? Second, managing the supply chain is a struggle. When demand is high, the retailers demand more inventory. When demand falls, retailers are tempted to discount prices, or force the company to buy back the inventory. Third, retailers take a big part of the profit.

Maybe the biggest problem is customer ownership. When you buy a Rolex from an authorized dealer, who gets the customer information? Does the retailer hold onto that? Does Rolex get it? The person most likely to buy a fancy Rolex is someone who already owns one. The relationship is exceptionally valuable for any brand.

The senior team at Rolex likely decided that owning the customer experience and contact was essential for long-term brand growth. If so, one option was opening stores. This is an unappealing path; the logistics are difficult and existing authorized retailers would oppose it.

Another option, buying Bucherer, makes much more sense.

The Industry Impact

This move will have a profound impact on the watch industry over time. The most immediate shift is that watch brands that have historically relied on Bucherer will need to find alternatives. When your distribution channel is controlled by a competitor, you are in a vulnerable position.

Over time, it is logical to expect to see Rolex and Rolex-owned brands like Tudor make up more and more of Bucherer’s retail space and sales. Other brands will have to scramble for space and attention.

We will also see a decline in the number of Rolex authorized retailers.

With Bucherer, Rolex may well focus on expanding its portfolio of brands, capitalizing on its retail footprint. This makes enormous sense.

Would we ever see Rolex merging with Patek? That seems inconceivable. But strange things happen. Who expected to see UBS buying Credit Suisse? A brand portfolio with Patek, Rolex and Tudor would be powerful indeed.

Comments RSS Feed