The Joy of Inflation

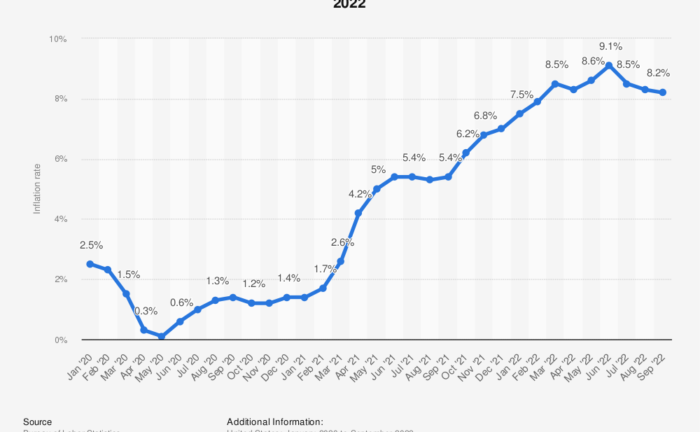

Happy Friday! Inflation is dominating the news these days. The Federal Reserve is boosting interest rates and reducing liquidity in an effort to slow the increase. Inflation is quickly becoming a dominant theme in the upcoming election, with Democrats being accused of sparking the rise with too much government stimulus.

There is no question that inflation is a problem. It is difficult for family budgets and the higher interest rates result in stock market declines, hurting pensions, 401k accounts and college savings. It is more difficult for people to buy a house.

For business leaders, however, inflation isn’t such a bad thing. Instead, in some ways a bit of inflation makes the task of leading a business much easier.

The Growth Challenge

Anyone leading a business faces the challenge of growth. Profit and cash flow must increase over time. This is certainly true for public companies; a company that isn’t going to grow will struggle to attract investors and its stock price will fall. It is also true for private companies. Private equity firms thrive on purchasing companies, quickly increasing the profit, and selling the firm for a healthy gain. Even family companies have to grow.

The problem is that growth isn’t easy. Incremental profits don’t just appear; they have to come from somewhere.

There are only a few options. If you simplify things a bit, you end up with just four potential sources of profit growth: market expansion, share growth, price increases and cost reductions.

These are all challenging. Market expansion, or category growth, is terrific, but it isn’t easy to find growing categories in developed areas like the U.S. and Western Europe. It is even harder in countries where the population is declining. Building market share is much easier said than done; competitors will fight hard to protect their share. Cutting costs is tough and it only gets harder over time. That leaves pricing.

In a world without inflation, price increases are difficult. Channel partners push back, saying “This is outrageous! How can you increase prices when your costs aren’t changing? This is just greed.” Competitors might not follow a price increase, resulting in share losses for the price leader. Customers might shift to brands that didn’t increase prices.

This has been the situation for the past decade. Profit growth was hard to find.

The Power of Inflation

When inflation is present, everything changes because a price increase becomes an easy and logical move. This pricing move can easily translate into profit growth.

Now with inflation, a portion of the price increase might be necessary to cover the higher cost of raw materials and wages. But part of the price increase will likely drop to profit. Even pricing up at just the rate of inflation will result in more profit; if costs are up by 5% and a company raises prices by 5% as a result, profits will grow.

Here is the math on that. Take a company selling 10 items for $10, which is $100 in revenue. Let’s say the cost of goods sold is $5 per unit, so $50 in total, with overhead of $30. That leaves a profit of $20.

Increase everything by 10% due to inflation. The price goes to $11, and revenues then go to $110. COGS increases to $55 and overhead increases to $33. Profits? Now $22, a 10% increase.

Things get better if you increase prices a little more than the rate of inflation. In the exercise above, push retail prices up by 15% and all of sudden profits are up by 35%.

For a manager responsible for delivering higher profits, inflation is transformational. Channel partners will understand the move. Competitors will follow the prices increase, because they are facing the same increase in costs. Customers won’t likely change behavior because everything is costing a little more.

Q3 Earnings

Companies are reporting earnings this week, and the story seems to be holding. Coke, for example, reported that profits grew more than expected as the company took prices up by 12%. KraftHeinz reported similarly positive news; through Q3, profits are up by 15.8% primarily due to price increases. Chipotle, too, reported that high price are helping build profits.

I was talking with one business leader recently and he reported that there was virtually no price elasticity. Prices were going up and volume was staying flat. Apparently since everyone expected inflation, they weren’t changing behavior with the higher prices.

The Bright Side

When you hear people complain about inflation, remember that not everyone is sharing in that distress. Many business leaders are delighted.

All this is one more reason why inflation won’t drop to zero anytime soon.

This essay reminds me of the SNL skit with Dan Aykroyd portraying Jimmy Carter saying “Inflation is our friend. Soon we will all be millionaires.” Inflation is hurting the middle and lower class people, but that’s obviously not a concern of yours.

There is no bright side when only Wall Street and senior executives make profits and bonuses at the expense of households finding it hard to make ends meet! Thanks for the math but I wish the article was not all about ‘profit maximization’ being the bright side!