Investing in a Tumultous World

The financial world is falling apart. Stocks are slumping, bonds – the “safe investment” – are doing almost as poorly. Bitcoin is down. Even gold, which should definitely be rising at a time of war and disruption, isn’t doing a lot.

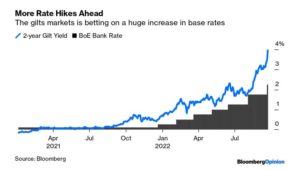

I was particularly struck by this chart from Bloomberg. Interest rates in the UK have absolutely soared in the past few days. It wasn’t too long ago that interest rates were negative.

A Long Term Look

I recently came across a spreadsheet showing what happened to a family member’s investment account over the past 28 years, from 1992 to 2021. The data included year-end account values, equity weighting and distributions; this account paid out the income from dividends and interest each year. Nothing was added to the account.

It is a fascinating document because it is real information. It isn’t a slick production from Merrill Lynch or Vanguard. It is just the actual results showing what happened to a small investment that was largely left alone for a long time.

The account was primarily invested in individual large-cap stocks. Not much happened; there was no effort to time the market or catch the next high-flying growth stock. The average equity weighting was 89.4%, with a high of 98.5% and a low of 86.0%.

The account provides some useful perspective at this unsettled time.

The Results

How did the account do? The overall results were amazing.

I won’t post the actual account values; let’s just adjust the starting value to $1,000. On 12/31/2021, the account was worth $6,128, which is an increase of more than 6x over the period.

Perhaps more impressive, the income distributions over that period totaled $1,100. Combined, the $1,000 investment turned into $7,228.

A Rocky Road

It was not a story of steady growth. The account value declined in eight of the years, so 29% of the time. The biggest decline was a 31.9% fall in 2008. The more discouraging stretch was 2000-2002 when the account value fell three years in a row, down 0.9%, then 12.4%, then 17.3%. That must have been a grim phase.

The account hit a high mark in 2007 before getting clobbered in 2008. It didn’t get back to that level until the end of 2013.

Still, despite all the ups and downs, the account value increased an average of 7.8% per year.

Implications

There are a few things we can learn from this account that can help us navigate these volatile days.

Buckle Up

If you want consistent returns, you shouldn’t be investing in stocks. Based on this account, you could say there is almost a 30% chance that you will lose money in any given year.

Turbulence is a necessary part of the stock market. If stocks always grew, then people would bid them up to crazy levels. The bumps create the returns. People are nervous about buying stocks and that makes prices reasonable and returns positive.

Have a Long-Term Horizon

If you need a pool of money anytime in the next few years, you shouldn’t put it in stocks. If you are getting ready to buy a house or pay college tuition, take those funds off the table.

Remember that 2008 decline of 31.9%. If you were planning to use that money to buy a house, well, you would find yourself looking for smaller homes.

For stock investments, think 10 years or more.

Get Some Dividends

Income is a beautiful thing. A small stream of dividends adds up over time. You might think a dividend yield of 2.3% is meaningless. Over 20 years that will turn into notable money.

Dividend stocks provide a level of stability that will help any account over the long-term.

Now What

We are heading for a notable year: stocks may well finish down 25%. This could be worse than 2008.

I suspect 2023 will be bad, too. When CDs start paying 5%, putting money in the stock market seems less appealing. Why go for a 2% dividend and a falling stock price? Just take the easy 5%!

But in 5 years, I believe stocks will have rebounded. Will they have reached new highs? I’m skeptical; I don’t think we will see negative interest rates anytime soon to propel equity valuations. But I’m very confident stocks will be generally moving up from the lows.

So, if you have investments that you don’t need right now, just ignore the news. Don’t open your statements. Keep investing a little if you have some extra cash.

If it really makes you ill to buy stocks, then it is probably the right moment to do just that.

Good note. I would add in the advice not to check your portfolio every day or every hour. Maybe once a week. Maybe even once a month. There is a good Warren Buffett quote too which I like: “The stock market is a device for transferring money from the impatient to the patient.”

An excellent suggestion! At the moment it feels like looking at a car crash. Just not productive at all.