Student Loans and Buyer’s Regret

One of the big issues in the U.S. today is student loans. People are astonished at the debt young people are dealing with, and presidential candidates are proposing various solutions that range from lower interest rates to debt forgiveness.

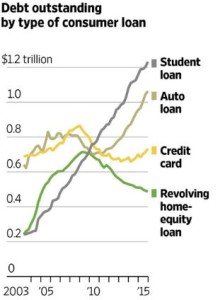

This all makes sense. Student loan debt is increasing at a dramatic pace because colleges are raising prices every year, and they’re raising them at rates that often far exceed inflation. Many young people are finishing college with $30,000, $50,000, or more in loans. For someone starting out, this is a significant burden, enough to make some people claim that student loan debt is slowing our economy by reducing household formation. The Wall Street Journal ran this remarkable chart today:

One of the strange parts of the discussion, however, is the lack of buyer’s regret. Graduates complain about their debt. Many express shock and outrage. Few, however, seem to regret their college decision.

This is puzzling. If the debt was such a problem, then logically people should regret their college choice and the associated financial implications. But few people say this. Graduates seem to be happy with their college experience and dismayed with the debt involved, but free of regrets overall.

In some ways, this is like a couple that goes out to a fancy dinner, has a wonderful time, and then is unhappy when they get the credit card bill. Still, they don’t regret going to the dinner–it was a lovely night.

At some point, this all might change. People might start saying, “Wow, I really regret going to the expensive college and taking on so much debt. I should have gone somewhere less expensive.”

This would encourage prospective students to ask the question: Is this college really worth the price? Application numbers at expensive institutions would then fall, especially at schools that don’t have a powerful brand. This would force schools to improve the value proposition through lower prices or a better experience. Tuition would decline and this would lead to lower debt.

For the moment, however, most schools have more than enough demand to fill classes and so the tuition continues to go up, along with student debt. With the lack of buyer’s regret among college graduates, the situation isn’t likely to change anytime soon.

Fantastic (and timely) post. My wife and I just had a conversation on the apparent lack of buyer’s remorse..

Tim:

Good post. I have been looking for the impetus that would move Universities to be more cost effective.

They have taken advantage of the government backed student loan programs to increase their “revenues” well beyond reasonable cost pressures. If left to market forces (read non government), they wouldn’t have be able to continue the higher education cost trend as long as they did.

We can only hope the current generation of college students will be more debt conscious than their predecessors.

Ken Templin

I think this is starting to change. I have a daughter about to apply to colleges next year and this is very much the conversation in our house and among many people we know. I also read a lot of articles and published data about this (e.g. “Best Value Colleges” articles, etc.). However, we do also know plenty of people who continue to pursue the prestige of an institution without regard to its costs and long-term costs. I want to say that many of the latter people either have the resources or seem to be concentrated around the northeastern U.S. where prestige is still considered a virtue.